The Goods and Services Tax (GST) has been a transformative reform in India’s indirect taxation system. To simplify compliance and streamline the filing process, the GST system leverages technology through tools like GSTN (Goods and Services Tax Network) for tracking and reporting.

Among the many features introduced under GST, GST ARN Status plays a significant role, especially in the filing of GSTR-3B return. Understanding what GST ARN status is and how it is related to GSTR-3B filing is crucial for businesses to ensure timely compliance and avoid penalties.

What Is GST ARN Status?

Defining GST ARN

ARN stands for Acknowledgment Reference Number, a unique identification number generated by the GST portal when a taxpayer takes certain actions, such as:

- Submitting a GST registration application

- Filing a refund application

- Filing GST returns online

It serves as an acknowledgment from the GST system that the taxpayer has successfully submitted the required document or form.

The GST ARN status indicates the current status of the form or request submitted, providing a mechanism for taxpayers to track the progress and resolve any compliance-related issues in a timely manner.

Structure of ARN

The ARN is a 15-digit alphanumeric code that follows a specific format:

- Begins with a two-character code denoting the state or union territory (e.g., “MH” for Maharashtra, “DL” for Delhi).

- The middle section contains numeric codes representing the year and month.

- The remaining segment consists of a unique combination of numbers and characters assigned to each transaction.

Instances Where ARN Is Generated

GST ARN is generated in various scenarios, including:

- GST registration: When submitting a new registration or amendment application.

- Refund applications: For GST refund requests.

- Filing GST returns: Such as GSTR-1, GSTR 3B, etc.

Purpose of ARN and GST ARN Status

By checking the GST ARN status, taxpayers can:

- Verify filing status – Confirm whether their submission has been successfully filed, processed, or rejected.

- Resolve errors – Identify discrepancies and take corrective action swiftly.

- Ensure timely compliance – Avoid penalties by monitoring status updates in real-time.

GSTR-3B: Bridging the Compliance Gap

Overview of GSTR-3B

GSTR-3B is a monthly summary return that captures consolidated details of:

- Outward supplies

- Input tax credit (ITC)

- Other tax liabilities for a particular period

It is simpler than detailed returns like GSTR-1 or GSTR-2 and helps the government monitor tax compliance periodically.

Key Components of GSTR-3B

- Details of outward supplies – Taxable turnover, exempt supplies, exports, categorized as intra-state or inter-state

- Input tax credit (ITC) – Summary of ITC claims

- Tax payable and paid – CGST, SGST, IGST, cess

- Interest and penalty – Late fees or penalties

Compliance Importance of GSTR-3B Filing

- Avoiding penalties – Prevent late fees and interest

- Claiming ITC – Ensures smooth utilization

- Ensuring liquidity – Reduces cash flow discrepancies

- Maintaining transparency – Regular compliance for businesses

Linking GST ARN Status to GSTR-3B Filing

ARN Generation During GSTR-3B Filing

When a taxpayer files their GSTR-3B return:

- An ARN is generated instantly upon successful submission

- It acts as proof of submission and acknowledgment from GSTN

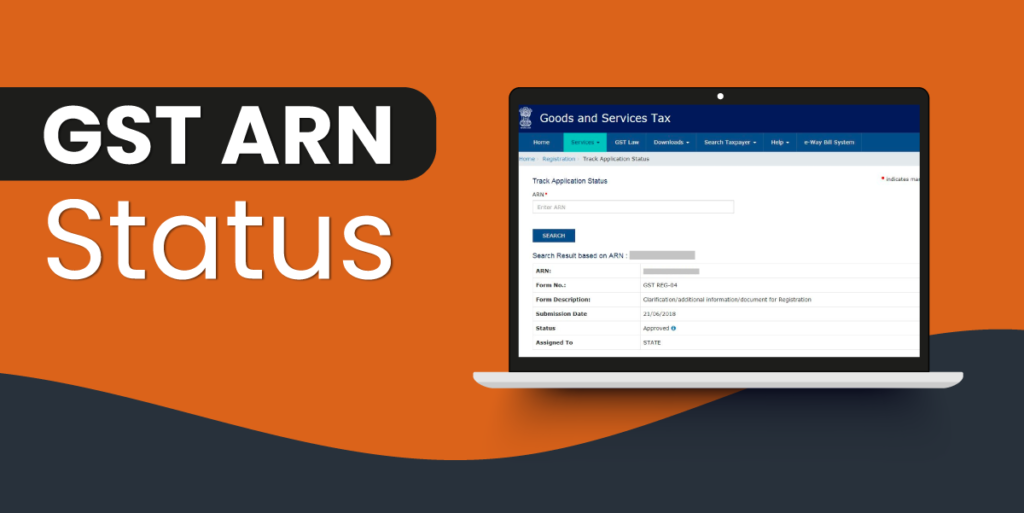

Tracking GST ARN Status for GSTR-3B Returns

Steps to track:

- Visit GST official website

- Log in with GST credentials

- Navigate to “Track Application Status” under “Services”

- Enter the ARN generated

- View the status

Possible status updates:

- Accepted – Successfully submitted and processed

- Pending – Under review

- Rejected – Errors require correction

Reasons for Monitoring GST ARN Status

- Confirmation of compliance – Avoid penalties and legal issues

- Resolution of errors – Address discrepancies quickly

- Transparency – Better financial and operational planning

Common Issues with GST ARN Status and GSTR-3B Filing

- Technical errors – Server or data mismatch

- Payment issues – Unsuccessful tax payments

- Incorrect details – Data entry errors in filing

Step-by-Step Process of Filing GSTR-3B and Checking GST ARN Status

Steps for GSTR-3B Filing

- Login on GST Portal

- Select GSTR-3B – From Returns Dashboard

- Fill in Details – Taxable turnover, ITC, liabilities

- Preview and Submit – Confirm and submit

- Payment of Tax – Pay dues via ledger or online payment

- Generate ARN – Proof of submission

Steps to Check GST ARN Status

- Log in to Portal – With GST credentials

- Track Application Status – Under Services

- Input ARN – Generated during filing

- View Status – Accepted, Pending, or Rejected

Corrective Actions for Rejected ARN Status

- Identify issues – Review rejection reason

- Reassess filings – Correct data errors

- Re-submit GSTR-3B – On GST portal

- Monitor updated status – After resubmission

Legal Implications of ARN and GSTR-3B Filing

- Late penalty and interest – ₹50/day, 18% p.a.

- Cancellation of GST registration – For persistent non-compliance

- Blocking ITC claims – For repeated filing failures

Best Practices

- Set reminders – For GSTR-3B deadlines

- Reconcile data regularly – Before submission

- Monitor ARN status – After filing

- Stay updated – On GST norms

Conclusion

GST ARN status is a vital compliance tool for tracking submissions under GST, including GSTR-3B filing.For businesses, understanding this link and following best practices ensures transparency, reduces penalties, and optimizes ITC utilization. By leveraging the connection between GST ARN status and GSTR-3B, businesses can navigate GST compliance with confidence.

Read more: What Is the Aluminium HSN Code and Freight HSN Code 8 Digit?